What's Included?

Safety & Security

Infrastructure

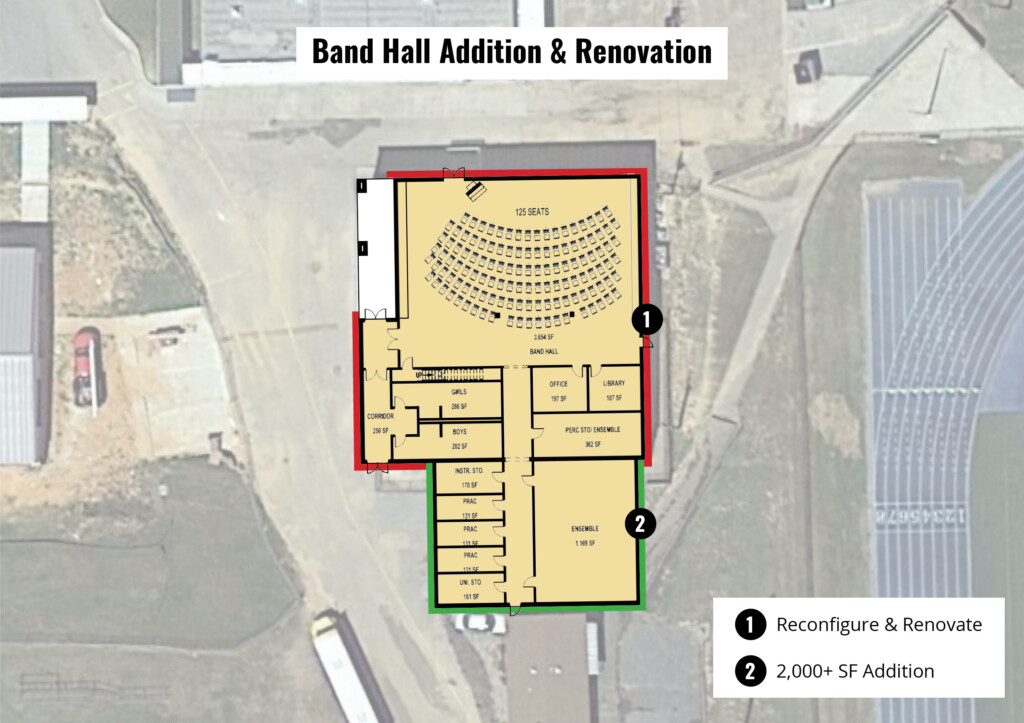

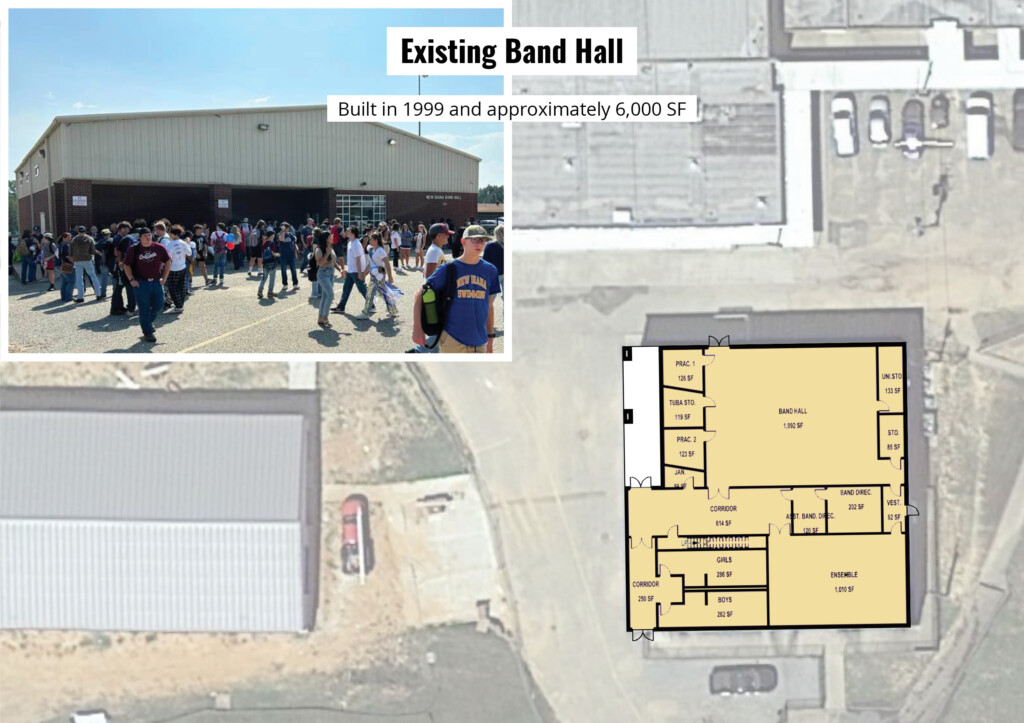

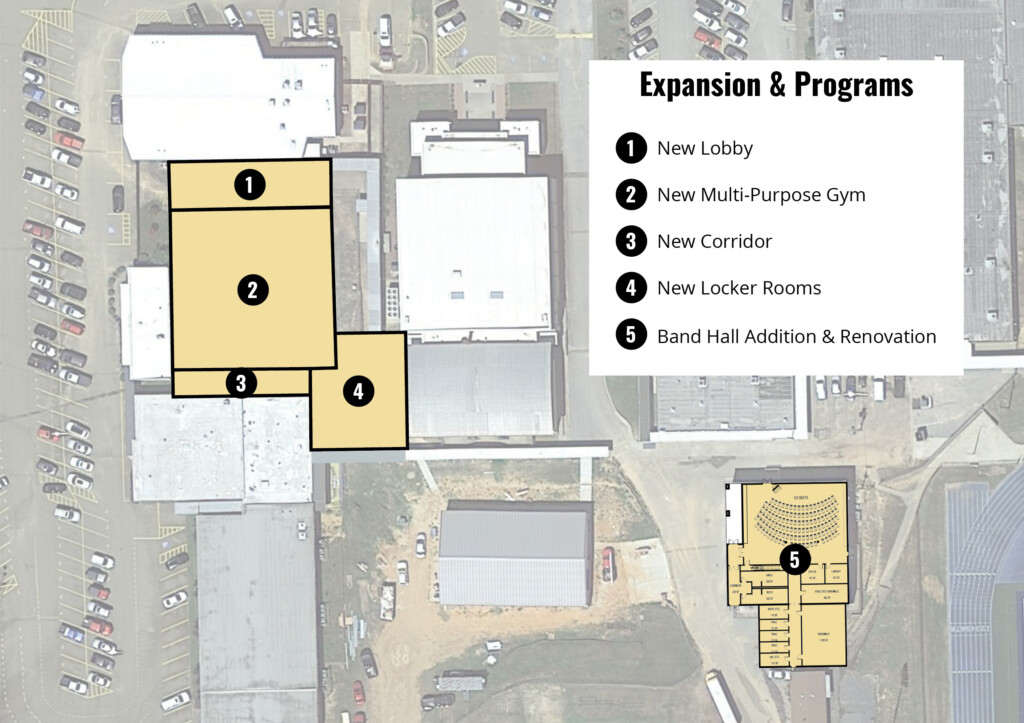

Expansion & Programs

Bond Summary

| Infrastructure | $3,340,000 |

| Safety & Security | $2,850,000 |

| Expansion & Programs | $22,060,000 |

| Total Bond | $28,250,000 |

To learn more about the bond summary, click the button below to view more comprehensive information. A Facilities Assessment was conducted in Fall 2021 on the physical conditions of the district’s facilities and sites.

DISCLAIMER: Cost estimates in the assessment are representative of pricing in the East Texas region for Fall 2021. A recommended 10 percent inflation per year may be assumed. Cost estimates do not include any anticipated general contractor overhead and profit, fees, permits or other soft costs.

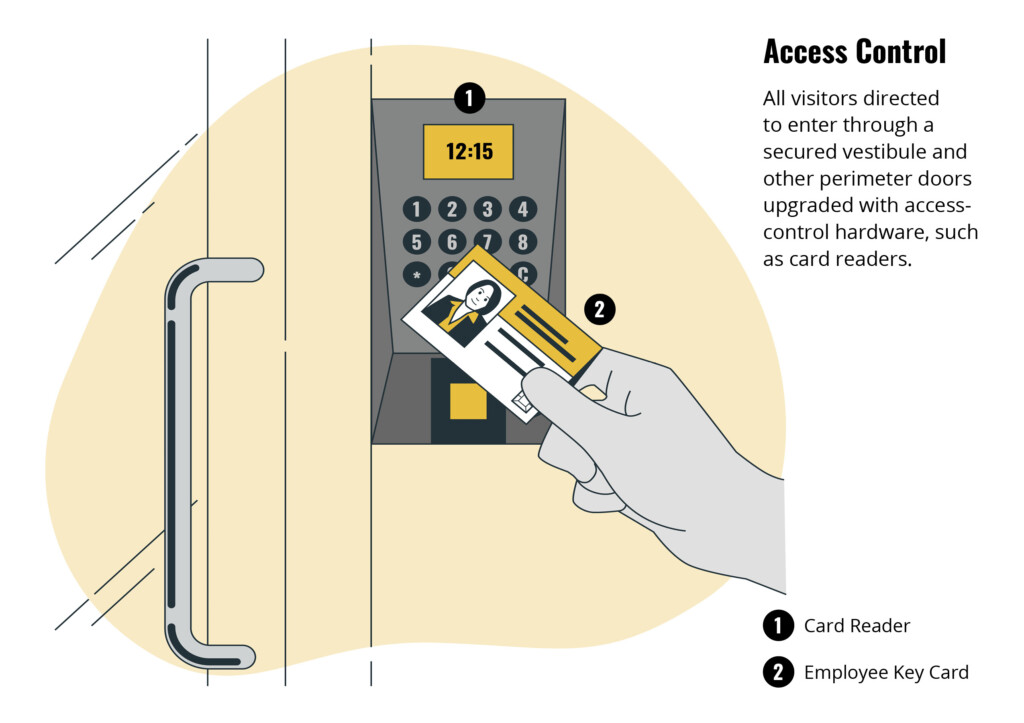

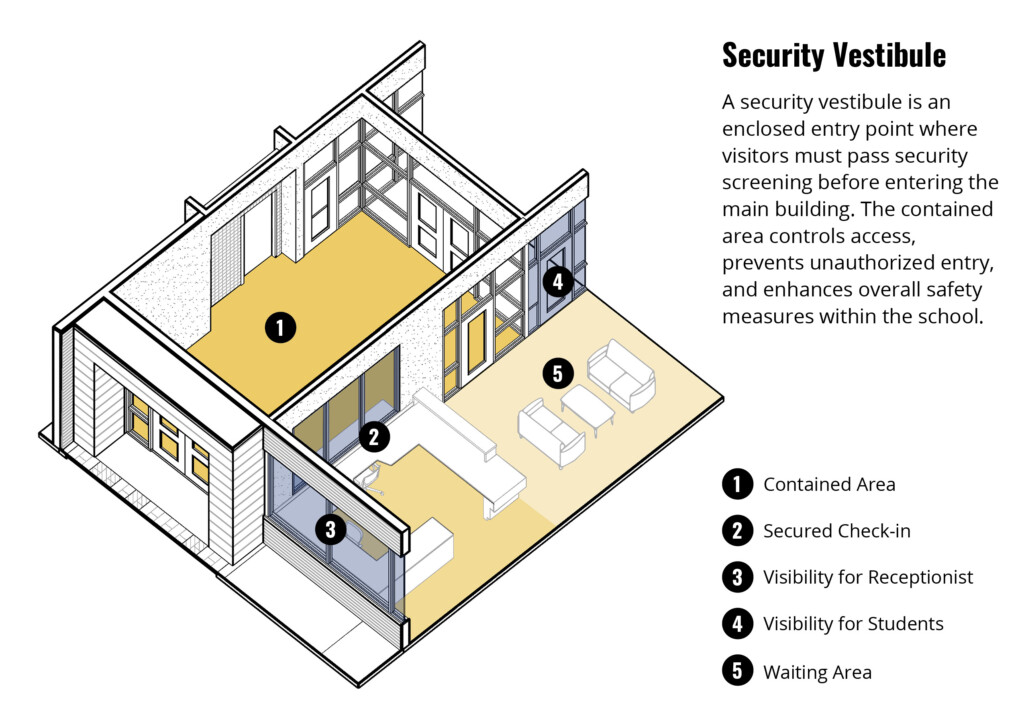

Our First Priority is Safety!

Safety comes first for us. New Diana ISD is committed to enhancing safety and security measures for the benefit of our students and our staff. We continuously seek opportunities to strengthen existing resources, implement new strategies and tools, and improve conditions where they play and learn.

Identifying Our Needs

The proposed bond package will focus on three areas: expansion & programs, safety & security improvements, addressing priority infrastructure/facility conditions, and further improving instructional program spaces.

About the committee

The New Diana ISD Bond Task Force Committee put a lot of hard work into studying the district’s facility conditions, safety & security of campuses, program considerations, bonding capacity, and other data. The committee was comprised of school district staff, students, and community members. One of the primary goals of the bond is to enhance the safety and security of students and teachers throughout the district. The bond also aims to renovate aging facilities as part of the district’s long-range preventative maintenance plan.

Understanding the Tax Rate

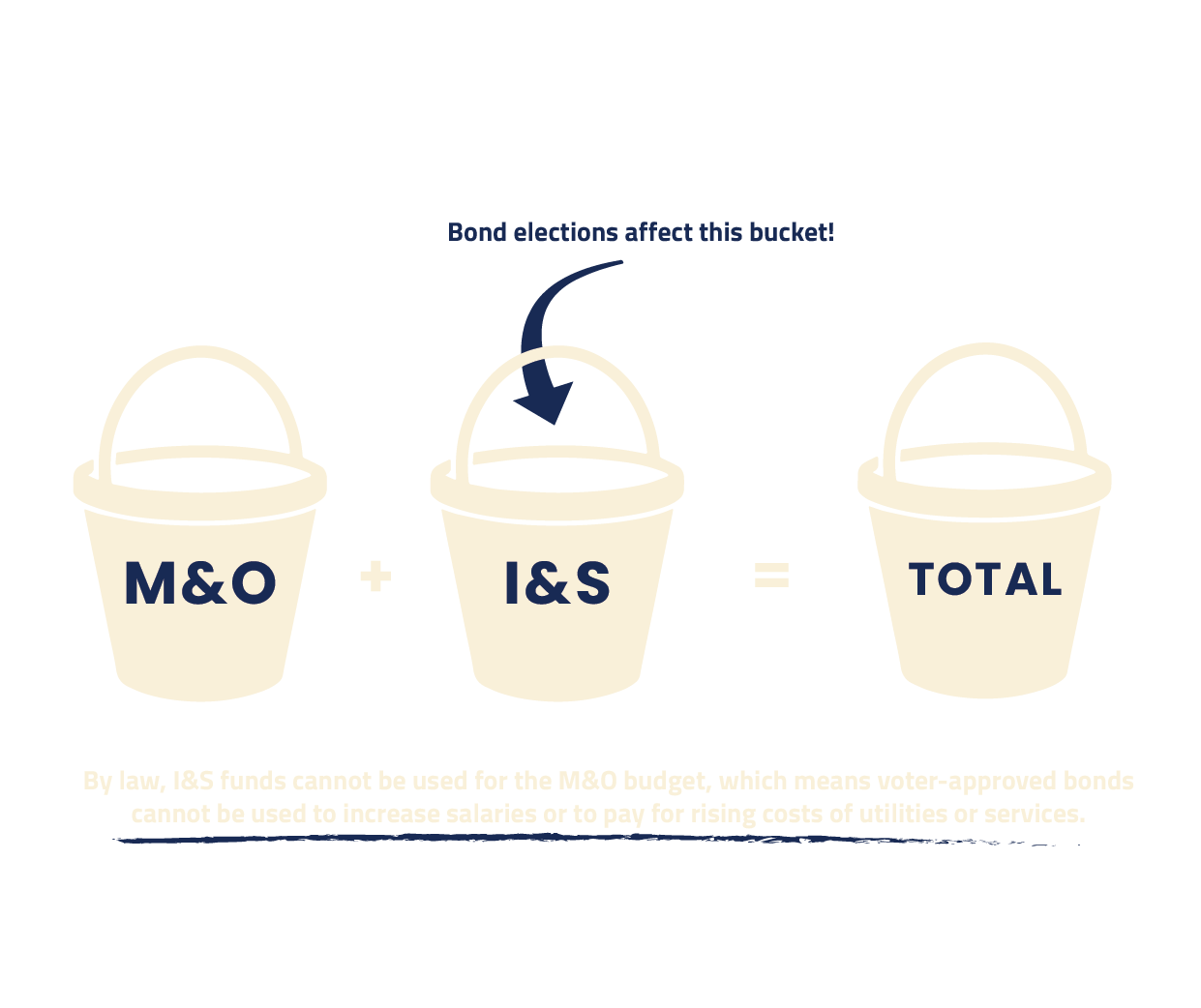

Public school taxes involve two figures which divide the school district’s budget into two “buckets.”

The first is the Maintenance & Operations (M&O) budget, also known as the General Fund. This is used to pay for the day-to-day operations of a district and includes items such as salaries, utilities, food, gas, supplies, etc.

The second is the Interest & Sinking (I&S) budget or Debt Service. This fund is used to repay debt for capital improvements approved by voters through bond elections. This fund is similar to a mortgage or home improvement loan.

Funds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land, and the purchase of capital items, such as equipment, technology, and transportation.

Voting Information

Anyone who is a registered voter and lives within the New Diana ISD district boundaries is eligible to vote in this election.

If you need to check your voter registration status or update your address, please click the “Voter Status” button below. To vote by mail in the May 2024 election, your application must be received, not postmarked, by Tuesday, April 23, 2024.

Early Voting

April 22-April 30

Election Day

May 4

FAQs

Just as homeowners borrow money in the form of a mortgage to finance the purchase of a home, a school district borrows money in the form of bonds to finance construction, renovation and other capital projects. Both are repaid over time, but in order for a school district to sell tax supported bonds, it must go to the voters for approval.

Bond funds can be used to pay for new buildings, additions and renovations to existing buildings, land acquisition, technology, buses, and equipment, among other items. By law, bond funds may not be used to fund daily operating expenses, such as salaries or utilities, which are paid for out of the district’s Maintenance & Operation (M&O) budget.

School districts are required by law to ask voters for permission to issue bonds in order to pay for capital expenditures for projects like building a new school or making renovations to existing facilities. Districts take out a loan and then pay that loan back over an extended period of time, much like a family takes out a mortgage loan for their house.

The New Diana ISD bond was developed by the Bond Task Force committee, which included staff, students, and community members. The committee met several times from August through November 2023 to study district needs at all grade levels and campuses and discussed the future vision for New Diana ISD students. The group studied facility conditions, safety & security, program considerations, bonding capacity, and other data before making their recommendation to the New Diana ISD Board of Trustees for consideration. The Board approved the recommendation in February 2024.

The proposed bond package will focus on three areas: accommodating growth for student enrollment, safety and security improvements, addressing priority infrastructure/facility conditions, and improving instructional program spaces.

With a typical homestead exemption, the tax impact will be approximately $0.00 per month for a $100,000 home and approximately $32.96 per month on a $200,000 home. The bond will result in no tax impact for homeowners ages 65 and older who have filed their senior citizen homestead exemption.

Homeowners 65 years of age and older can freeze their tax rate as long as they have filed for their senior citizen homestead exemption. The bond will result in no tax impact for voters ages 65 and older who have filed their senior citizen homestead exemption.

From school bonds. Likened to a home mortgage, a voter-approved school bond allows a school district to borrow funds. The Board of Trustees authorizes bond elections, and Texas law grants the Board the authority to sell bonds.

Prior to any bond vote, a volunteer citizen committee is usually created to develop a bond package for presentation to the Board of Trustees. The Board approves the bond package – the specific uses of bond monies and the estimated costs for each project included in the bond.

After voter approval, the school district can sell bonds to investors who are repaid their principal plus interest. Payout is limited by law to 40 years. The district sells bonds that mature at different times, so bond expenditures for items with a shorter lifespan are paid off before the purchase becomes obsolete. This also allows the district to capture the lowest interest rates available.

Importantly, bonds do not cost the district anything until they are sold. A district receives a higher rating due to the guarantee by the Texas Permanent School fund, having a strong fund balance, and maintaining a record of financial management excellence. Of course, market conditions will affect the actual interest rates, which may be higher or lower than the original estimates.

As state agencies, school districts rely on M&O funds to pay for the day-to-day education of the district’s children.

Bonds allow districts to spread the cost of expensive projects across time without affecting the district’s normal educational operations. Also, bond funds all stay with the district, and they are not subject to state recapture, fluctuations in revenue due to state mandates, or other negative economic influences.

In short, bonds save and protect taxpayers while allowing for essential, ongoing facility development and other capital expenses to be funded.

Voters approve a specific dollar amount— or the maximum amount the district is allowed to sell without another election. The school district may then sell their bonds as ‘municipal’ bonds when funds are needed for capital projects, usually once or twice a year.

The interest rate paid is based on the district’s bond rating and the interest rates in effect at the time of sale.

Districts benefit if they have a higher bond rating, meaning a lower interest could be charged. Principal and interest on the bonds are repaid over an extended period with funds from the Debt Service tax rate. (Source: TASB).

Thus, there are two parts to any bond process:

1) bond authorization that specifies the amount of bonds the district is authorized by the voters to sell, and

2) bond sales that may occur over a period of time with the date and amount of each sale determined by the Board on an as-needed basis. (TASB).

Note that a district is not obligated to spend all the authorized monies but cannot exceed the authorization.

A school district’s tax rate consists of two parts:

• Maintenance and Operations (M&O) which funds the General Operating Fund, which pays for salaries, supplies, utilities, insurance, equipment, and the other costs of day-to-day operations; and

• Debt Service (Interest & Sinking or I&S) can be used for a variety of special purposes, assuming voter approval. For example, they may finance facility construction and renovation projects, acquire land, or purchase capital equipment, such as technology, and transportation, such as buses.